40 Under 40: India’s brightest young business minds

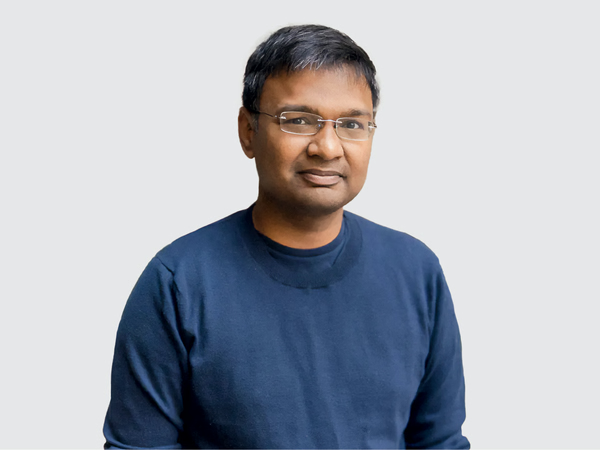

Abhinav Shashank,

Last 12 months have been the most significant period in the decade-long entrepreneurship journey of Abhinav Shashank, co-founder and CEO of San Francisco-based health-tech firm Innovaccer. The company offers data analytics and data activation tools to accelerate healthcare innovation. Innovaccer’s solution suite is a collection of digital solutions that can be customised by its clients using modular building blocks. The company charges its clients for tailor-made software it builds. From $95 millon in revenues and a cash burn of $25 million in 2023, Innovaccer expects to end 2024 with revenues of $130 million and close to zero cash burn. In 2023, Innovaccer launched ‘Sara’, a healthcare-specific AI solution designed to meet operational needs of the healthcare sector in the U.S. ‘Sara’ promises 83% accuracy in executing complex healthcare queries compared to other AI models such as Open AI GPT-4, says Shashank.

Abhiroop Medhekar, Saurav Swaroop

FAILURE IS THE first step to success but the founders of Velocity, Abhiroop Medhekar and Saurav Swaroop, have lived the idiom as entrepreneurs. Before founding Velocity, the duo had launched Taskbob in 2015. After raising ₹25 crore via VC funding, Medhekar and Swaroop decided not to raise more capital. The result: Taskbob did not survive the funding winter of 2017. Cut to 2020, Medhekar and Swaroop created Velocity, a revenue-based financing platform that enables digital-first start-ups access financing products. The company has so far raised $30 million in equity funding with its biggest investment from Valar Ventures, a New York-based fund backed by Peter Thiel, the former co-founder of Paypal. Velocity is Thiel’s solo Indian investment. It primarily works with SME-focused lenders such as U Gro Capital, Credible Capital and Trillionloans and builds their loan books online by bringing both lenders and borrowers on the company’s platform. In case a borrower defaults on a loan, 5% of the financial risk is borne by Velocity (fintech provider) while the rest is borne by the lender, says Medhekar, co-founder and CEO. Velocity’s business model is fee-based where it gets a commission of 6% and 10% (depending on the loan size and duration) from the lenders during the course of the loan. Till date, Velocity has serviced over 4,000 brands and facilitated disbursal of more than ₹750 crore in loans. Its clients include start-ups such as French Crown, Iconic Fashion, Soulflower, Chumbak, IDC Kitchen, Off Duty, Itsy Bitsy, Bear House, and Zlade. Velocity’s primary product, revenue-based financing, has enabled over 900 businesses, especially, D2C and ecommerce brands, overcome working capital needs. The platform also offers products such as fixed EMI, revenue-based ODs, credit lines etc. Start-up founders who do not want to dilute their equity are the biggest clients, says Swaroop, co-founder and CTO. The company has achieved 2.2x YoY growth, expanding both disbursals and revenues. It has more than 100% net revenue retention rate and has maintained NPAs at less than 1.5%.

Abhishek Chakraborty

ABHISHEK CHAKRABORTY is reaching out to new consumers such as sweetmakers who want to ship perfectly preserved rasgullas or sandesh, women entrepreneurs running small businesses on Instagram, or small D2C brands that need packaging or fulfillment solutions. “DTDC is one of the few firms in India that can handle temperature-controlled products using a normal network,” says Chakraborty. DTDC Express is using insulated packaging combined with temperature-regulating materials such as dry ice instead of relying solely on refrigerated vehicles to transport temperature-sensitive goods. The company, which runs three primary verticals, including express parcels, international, and e-commerce, saw its revenues jump 21.8% YoY to over ₹2,000 crore in FY23. With an international presence in the U.S., Canada, the U.K., the U.A.E., Singapore, and Australia, it recently added Malaysia to its global footprint. “We’ve seen 30-35% growth in our global business,” says Chakraborty. DTDC has 16,500 touchpoints in India where customers can access its services, and 16,000 partners. The DTDC app launched in 2020 has over 3.1 million downloads and 400,000 active users.

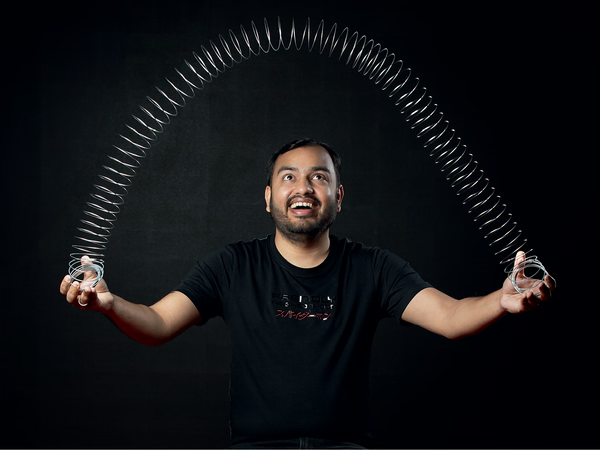

Agnishwar Jayaprakash

AGNISHWAR Jayaprakash, founder and CEO of Chennai-based drone start-up Garuda Aerospace wishes Mahendra Singh Dhoni’s association with Chennai Super Kings and the IPL should continue for a few more years. Dhoni, the brand ambassador and a minority investor in Garuda Aerospace, is the face of the company, which is among India’s top drone makers and one of the pioneers of multipurpose drone making since 2015. The company has come out with a foldable nano drone that fits into one’s pocket — Droni — named after Dhoni. Garuda makes customised unmanned aerial vehicles (drones) for multiple uses, including sanitisation of public spaces, delivery of medicines and food, vaccinations, surveillance, solar panel cleaning, crowd management and the like, but has become a specialist in agriculture drones. It has already sold over 1,500 ‘Kisan’ drones for spraying insecticides, pesticides and herbicides, seed sowing, crop manning etc. “Garuda has sold 2,500 drones so far, out of which 2,000 are agri drones. We plan to sell 25,000 agri drones in the next two years and at least 25,000 other consumer drones in the next few years,” says Jayaprakash. The company has 400-plus clients, including L&T, Tata, Godrej, Reliance, Adani, NTPC, SAIL, IOC and ONGC. More than half of the agricultural drones used now in India are from Garuda, says Jayaprakash. No wonder, revenues grew from ₹2.3 crore in FY21 to ₹47 crore in FY23. The company, which targets to become the first unicorn among Indian drone makers by next year, is planning an IPO by year end or early next year.

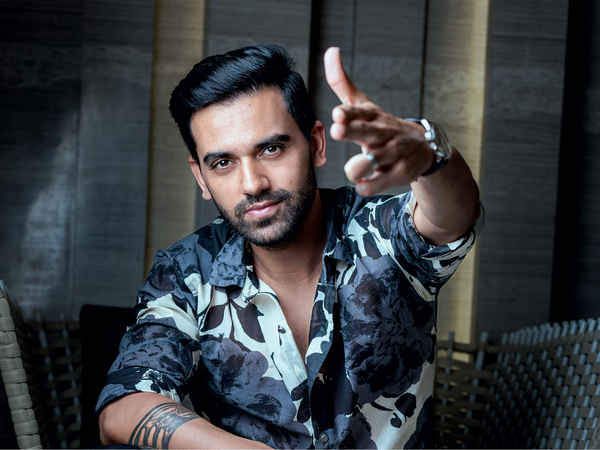

Akash Ambani

What Akash Ambani does in Reliance Jio is mostly out of bounds for outsiders. The elder son of Mukesh Ambani who was involved in the creation of Jio from its concept stage 13 years back eventually threw up a host of surprises, including the launch of India’s first free-voice telecom business in 2016. These days, Akash spearheads the development of products and services that leverage 5G, Artificial Intelligence (AI), Blockchain and the Internet of Things. The company aims to enable a generational shift in commerce, education and healthcare delivery with these technologies. Jio is India’s largest telecom service provider with a wireless subscriber base of 468 million as of February 2024. In FY23, it reported gross revenues of ₹1.15 lakh crore. For the first nine months of FY24, gross revenues stood at ₹94,687 crore. Akash was appointed the chairman of Reliance Jio Infocomm (RJIL) in June 2022. He has served as non-executive director on the board of RJIL since 2014. He is also a part of the leadership team of RIL’s retail arm, Reliance Retail Ventures (RRVL), as a director. Since his appointment as chairman, RJIL has seen its subscriber base grow to 468 million from 413 million, including over 90 million 5G users. The telco has launched Jio True 5G, which covers over 96% of the census towns in the country and carries one-fourth of the mobility data traffic of Jio subscribers. At the India Mobile Congress last year, Akash announced the launch of the satellite-based GigaFibers, which provides wireless broadband services.

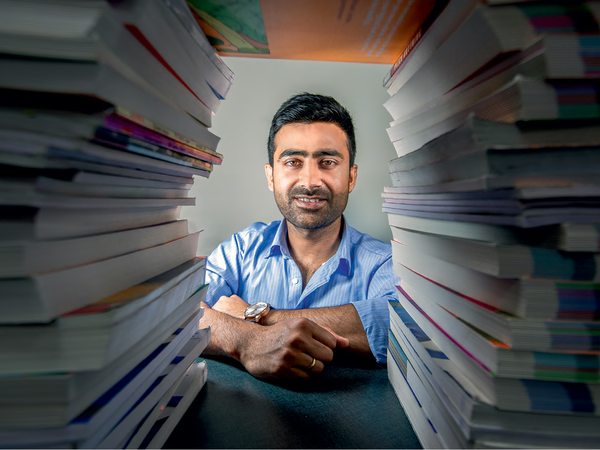

Alakh Pandey

IN THE LAST two years, Physics Wallah — an edtech platform training school students and those preparing for JEE, NEET and other competitive exams — has opened about 130 offline centres in over a 100 cities across the country. Its reach now extends to 4.3 crore students on YouTube across 85 channels. The company also has around 27 lakh students using its PW app, which offers courses across 35 exam categories. As the Noida-headquartered edtech unicorn scales rapidly, founder and CEO Alakh Pandey says he is focussed on bringing more financial discipline to the company. “Three years ago, we had no offline centre, today we have 130... right now we have the brand and this is the best time to scale pan India,” says Pandey. The firm’s revenue from operations rose to ₹772 crore in FY23 from ₹233 crore in FY22. In the next one year, Pandey plans to make affordable smartphones with an educational operating system, tentatively priced at ₹8,000-10,000, and launch an NBFC that offers loans to economically disadvantaged students on the basis of academic credibility.

Anand Piramal

IN HIS STUDENT years, Anand Piramal, executive director, Piramal Group, was in two minds about whether to get into consulting or banking to kickstart his career. He approached family friend and now his father-in-law Mukesh Ambani, chairman of Reliance Industries for advice, which changed the course of his thinking. Ambani told him, “Being a consultant is like watching cricket or commenting about cricket, while being an entrepreneur is like playing cricket.” Anand chose to be an entrepreneur and founded Piramal Realty, now one of Mumbai’s premier developers with prime residential and commercial properties across Mahalaxmi, Byculla, Thane, Kurla, Lower Parel, and Worli. According to Capitaline database, Piramal Realty reported a total income of ₹1,832 crore in FY23. In 2017, Anand joined the board of Piramal Enterprises as a non-executive, non-independent director, as part of his father Ajay Piramal’s plan to groom next-generation leaders. In 2022, Piramal Pharma was demerged from Piramal Enterprises to create two separate listed entities. Anand now heads the financial services business of the group, one of the country’s largest NBFCs specialised in affordable home lending, SME lending, construction finance, and mid-market corporate lending. Piramal Enterprises posted consolidated revenues of ₹9,087 crore in FY23, and net profit of ₹9,969 crore. Assets under management stood at ₹63,989 crore in FY23. Anand oversees Piramal’s alternatives business, a fund with $1.5 billion under management and tie-ups with CDPQ, Bain Capital, CPPIB and others.

Ananya Birla

ANANYA BIRLA has two goals running parallel while running a business — profitability and impact. Svatantra Microfin, which she founded in 2012 at the age of 17 to provide micro loans to women entrepreneurs in rural India, is currently the second-largest player in the NBFC-MFI segment, with a 4.2 million customer base across 20 states. Assets under management stood at ₹13,000 crore in FY23. “I would like my businesses to be profitable, but I also want them to create an impact,” says Ananya Birla, daughter of billionaire industrialist Kumar Mangalam Birla. Ananya is also on the board of Aditya Birla Management Corp. Pvt. Ltd — the group’s apex decision-making body that provides strategic direction to group companies — along with her brother Aryaman Vikram Birla. Ananya believes small steps can make a big impact. “My head office is plastic-free. The group aspires to achieve net-zero carbon emissions by 2050... Aditya Birla Fashion & Retail Ltd. has already achieved zero waste to landfill across its facilities,” says Ananya. “One of the biggest challenges for me is balancing performance with humanity,” she adds. “I want teams to be hardworking, but I don’t want them to burn out,” says Ananya, who co-founded the Mpower movement with mother Neerja Birla in 2016, an awareness initiative to alleviate the stigma associated with mental health.

Ankush Grover

A FOODIE'S JOY knows no bounds, especially if his job involves savouring a range of delicacies on a daily basis to decide what would suit the palate of a wide spectrum of consumers, from Gen-Zs to millennials. Thirty nine-year-old Ankush Grover, co-founder and CEO, India, Rebel Foods — which owns popular brands Behrouz Biryani, Faasos, and Oven story etc, operates master franchises of Wendy’s burgers, and partners brands such as Natural Ice Creams — is candid enough to accept he is a foodie and occasionally ventures into the kitchen to try his hands at new recipes. The chicken bhuna wrap of Faasos, from which Rebel Foods’ journey as a single brand began almost a decade back, is his personal favourite. Over the last 10 years, Rebel Foods has evolved as the largest Internet restaurant chain with over 45 brands under its fold including franchises, a D2C channel EatSure, and is developing more brands in the fried chicken and health categories. Revenue rose 24.6%, from ₹1,400 crore in December 2022 to ₹1,750 crore in December 2023. Measures to improve margins and optimise costs led to a 23% improvement in operating EBITDA margins. Brand-specific innovations to get closer to customers have been key, says Grover. “We are at 350 kitchens and our vision is to go to 700 in the next three years and 1,000 plus by 2030. Today we are in 60-plus cities and the idea is to be in 150-200 cities in the next five years. A lot of expansion will take place going ahead,” says Grover.

Anmol Singh Jaggi

THE WORLD these days is facing a unique challenge — how to balance the needs of an energy hungry civilisation while addressing the issues of climate change that power generation brings forth. Anmol Jaggi had set out to deliver solutions to the dilemma, more than 15 years ago, by venturing into the clean energy sector. Jaggi forayed into carbon trading when he was in his final semester in college, buying carbon credits from wind farms in India and selling them to European firms. Today, his company Gensol Engineering Ltd. is a one-stop shop for all things related to solar power generation, from advisory services to turnkey EPC projects to being an OEM. The company also entered the EV manufacturing sector in 2023 and announced its maiden electric vehicle to be manufactured at its greenfield plant in Chakan, Pune. The facility can produce 30,000 EVs per annum. Gensol has also put up 600MW of solar projects, including rooftop, ground-mounted, and floating installations, across India. It has expanded its footprint to South-East Asia, West Asia, and Africa. In 2019, Jaggi co-founded BluSmart, which operates in the EV ride-hailing and EV charging infrastructure space in Delhi-NCR and Bengaluru. Its total fleet of nearly 7,000 EVs has saved 31,000 metric tonnes of CO2. It currently operates 40 charging hubs with 5,000 charging stations. Gensol’s revenue grew 145% YoY to ₹390 crore in FY23, while BluSmart crossed $50 million in annual revenue run rate, delivering over 100% YoY growth.

Arjun Juneja

ARJUN JUNEJA grew up playing cricket as a leg spinner, right from grade 4, and went on to play up to the state level. His love for cricket now reflects in the company’s marketing campaign which features former India captains Sourav Ganguly and Anil Kumble. Juneja joined Mankind Pharma in 2008. In FY23, the revenue stood at ₹8,749 crore. The company is a leading player in the domestic pharmaceuticals space, especially in acute and chronic therapeutic areas, including anti-infectives, cardiovascular, gastrointestinal, anti diabetic, neuro/CNS, VMN and respiratory. In consumer healthcare, it operates in condoms, pregnancy detection, emergency contraceptives, among others. It has 28 manufacturing facilities across the country. The company’s biggest brand is Nurokind (acute and chronic) valued at ₹579 crore with a market share of 14.45%. In chronic, its Telmikind ranks first with ₹554 crore and has a 10% share of the hypertension segment. For Juneja personally, the inflection point came in 2009-10 when he started leading business development. “Cold calling randomly got us the first break with UCB (Union Chimiqe Belge) of Belgium, which offered us Longifene, an appetite stimulant for children, for marketing,” says Juneja. Eventually Mankind brought UCB’s india business. Another major inflection point was setting up R&D for Mankind in 2012 with a molecule called Dydroboon. The gamble paid off and Mankind became the second company in the world — after Abbott — to offer the infertility product for women. Juneja also led the company through its listing last year.

Arun Vinayak

ARUN VINAYAK co-founded Exponent Energy — a fast-charging ecosystem for electric three-wheelers — during the pandemic in 2020, just when he was exiting the founding team at Ather Energy, the premium electric bike maker. “I realised my job at Ather was done. The products we built were ready to scale. I decided we need to double down on the energy problem statement. We realised commercial vehicles need this solution,” says Vinayak. Exponent sells battery packs to OEMs that can be fast-charged in 15 minutes. “Our dollar per kilowatt hour pricing for battery packs is 10% more because we give rapid charging. But we put a 30% smaller battery. When you do that entire math, the sticker price comes down and we end up being a little cheaper,” says Vinayak. The three-year-old start-up rolled out its first electric cargo three-wheeler by tying up with Altigreen last year. In April, it tied up with Omega Seiki Mobility to launch a passenger three-wheeler for ₹3.25 lakh. “With passenger vehicles, we are going to see a huge uptick in volumes,” says Vinayak. The start-up is looking to set up 40 charging stations in Delhi. It also plans to roll out batteries for electric buses this year. “We are not just a battery supplier. We are an energy partner. We work with OEMs to create a demand ecosystem,” says Vinayak. Exponent says its charging stations top up 20-30 vehicles every day. “We charge ₹16 per unit to the end user while our cost of electricity is ₹6-7,” says Vinayak. It costs ₹5 lakh to set up a charging station, he adds. The TDK Ventures-backed start-up has raised $44 million so far.

Deepak Chahar

IN THE sprawling cricket grounds of Rajasthan, at the tender age of 12, Deepak Chahar stepped onto the pitch, fuelled by the inspiration of his father. A mischievous child with boundless energy, his father saw cricket as a means to instill discipline in him. Little did they know, this would spark the rise of a cricketing star and an innovative entrepreneur. Fast forward to today, Chahar stands as one of India’s most promising cricketers. A key member of the Chennai Super Kings, his achievements include being the only Indian to secure a hat-trick in the T20s. However, his impact transcends the cricket pitch. In 2022, he embarked on two ventures, challenging conventions and disrupting industries. The first is TFG (Trade Fantasy Game) — fantasy cricket, established under JCDC Sports Pvt. Ltd., which revels in its unique six-player format as against the industry standard of 11. The app focuses on user-interface to incorporate innovative game-play features. The second, D-NINE, established under LCDC Athletics Pvt. Ltd., provides quality cricketing shoes and health supplements at affordable prices. The nutrition products are made by a third party, FMCG company Weolive, while shoes and other sports gear are produced through contract manufacturers based in Rishikesh and Dehradun. “My wife and my father handle the daily operations of both the businesses. I contribute as an advisor,” says Chahar. TFG, launched in February 2023, has an average 30,000 playing on the app daily. The platform aims to surpass 3 lakh users during the IPL season. Meanwhile, D-NINE clocked sales of ₹1.2 crore in the last six months and forged partnerships with 30 distributors.

Deepak Dara

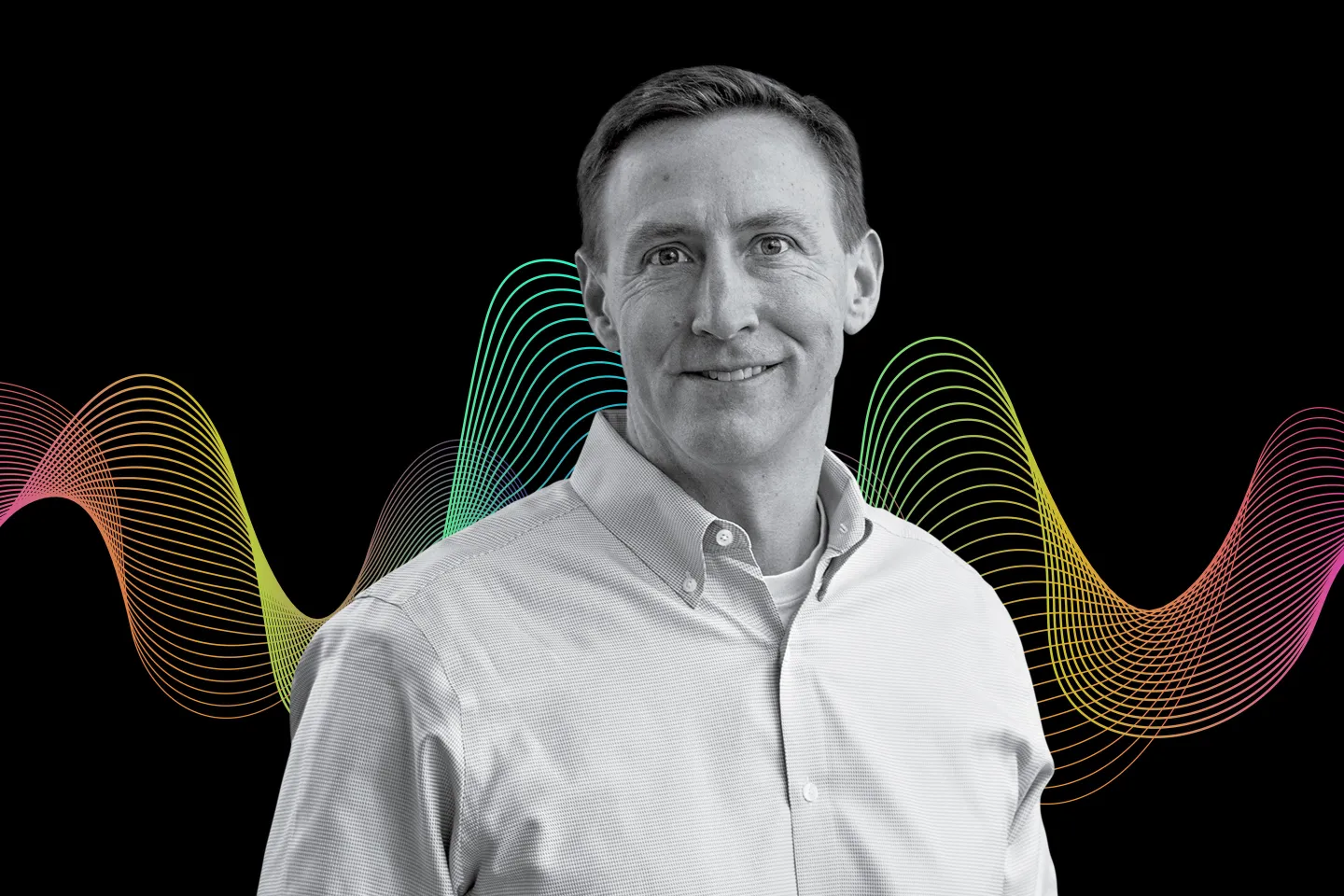

WHEN HE left the Indian shores in 2009, Deepak Dara, senior MD of the Ontario Teachers’ Pension Plan (OTPP), was not sure about his ultimate calling. Born and raised in India, Dara’s foundational years in his homeland laid the groundwork for an international career that spans continents. After leaving India in 2009, he pursued MBA at Duke University, a decision that would crystallise his journey into the financial world. Post-MBA, he joined Capital One, further refining his expertise in finance. However, Dara’s ambitions saw him transition from the world of consulting, where he worked with PwC, Booz, and BCG, to a pension fund. In 2020, a new chapter began for Dara as he joined OTPP, bringing with him experience and perspective shaped by years of international exposure and a diverse professional background. As advisor to the chief investment officer and the investments executive team, Dara played a pivotal role in shaping the organisation’s investment strategy, particularly through the lens of his understanding of both global and regional market dynamics. As the senior managing director for OTPP, Dara’s return to India in early 2023 marked a full-circle moment in his career. His experience across multiple asset classes has helped OTPP’s expansion in the region. With over CAD 4.5 billion poured into India, Dara and his team have been cherry picking investments across PE and infra space with a focus on renewables. As the Canadian fund aims to hit $300 billion in assets by 2030 from the current CAD 247 billion, Dara knows a lot will be riding on his shoulders.

Devansh Jain

INOX wind, which manufactures wind turbines and generators, has four manufacturing plants — at Rohika and Bhuj in Gujarat, Barwani in Madhya Pradesh and Una in Himachal Pradesh. All these plants are on an overdrive to meet rising orders. “Our order-book is now 2.6GW, translating into a revenue visibility of ₹18,000-19,000 crore in the next two-three years,” says Devansh Jain, executive director, INOXGFL Group. Wind equipment is not the only area where INOXGFL Group is invested heavily. Riding on new energy forms and planned investments of over ₹10,000 crore in niche renewable energy forms such as chemicals and fluoropolymers for EV/ESS batteries, hydrogen fuel cells and electrolysers, the group is looking at an EBITDA of over ₹5,000 crore in three years, says Jain. On the back of India’s chemical boom, Gujarat Fluorochemicals Ltd. (GFL), the flagship company of the INOXGFL Group, has seen increasing demand across the globe and in India. GFL is the country’s largest polytetrafluoroethylene/fluoropolymer manufacturer. The product has applications across industries such as oil and gas, pharma, food, automotive, aerospace and defence, electricals and electronics. GFL’s consolidated revenues grew 44% YoY to ₹5,685 crore in FY23, while PAT grew 71% YoY to ₹1,323 crore. The company is looking at a push into renewable energy and sustainability opportunities. It is in the process of setting up an integrated battery chemicals complex under GFCL-EV, and the first phase has already taken off. “There is hardly any competition outside of China from players who make raw materials for lithium-ion batteries. The products we make and will be making, constitute about 40% of the cost of such batteries,” says Jain. Another new subsidiary is GFCL Solar and Green Hydrogen Products, which will offer fluoropolymer solutions for the entire solar and green hydrogen value chain. Internally researched and developed proton exchange membranes will tap opportunities in the green hydrogen ecosystem once it takes off, says Jain. INOXGFL’s market capitalisation stood at over ₹65,000 crore as of March 31, 2024. “Our focus will continue to be on strong EBITDA generation, as new growth engines in coming years are in niche and specialised products where margins are high,” adds Jain.

.avif)

Harshad Reddy

HARSHAD REDDY is a sports buff who runs and cycles regularly, something he finds meditative. An avid supporter of Manchester United, Harshad has run a few half marathons, with a long-term goal of the Boston Marathon. In 2014, Harshad set up Apollo Hospitals’ home-care enterprise, but one of his bigger achievements has been the Apollo Proton Cancer Centre (APCC) in Chennai, the first such facility in South Asia and West Asia, in 2019. Even today, the only other entity to have a similar facility in the region is Mumbai’s Tata Memorial Centre. In proton therapy, there is no entry or exit load from the radiation. Essentially, it ensures it does not radiate non-cancerous tissues “We were literally putting in a cyclotron, a nuclear reactor in the middle of Chennai, something that the country hadn’t seen before. Therefore, it took a while for regulators to understand the requirements,” says Harshad. Getting approvals from the Atomic Energy Regulatory Board itself took two years. Set up at a cost of ₹1,250 crore, APCC has treated over 400 patients with proton beam therapy last year, even from far away New Zealand and Chile. Earning from APPC during FY23 was ₹220 crore, followed by ₹264 crore in FY24. Harshad hopes to bring more cutting-edge technologies to India. Recently it launched ZAP-X, a gyroscopic radiotherapy platform to treat brain tumours at the Indraprastha Apollo Hospital in Delhi.

Harshil Mathur

HARSHIL MATHUR'S journey to make Razorpay one of India’s leading full-stack financial solutions providers didn’t start off so well. He, along with Shashank Kumar, fellow classmate at IIT Roorkee and now co-founder and MD, faced numerous rejections from banks before finding one (HDFC) who partnered with them to go live as the payment gateway. “Today, we work with most banks in enabling payment acceptance for their businesses,” says Harshil, co-founder and CEO. The Bengaluru-based start-up provides tech payment solutions to over 8 million businesses, including OYO, Zomato, Nykaa, Zerodha, Swiggy, BMW and NIIT. Last valued at $7.5 billion in December 2021, Razorpay has raised $742 million in funding in 11 rounds, led by Lone Pine Capital, Alkeon Capital, TCV, GIC, Tiger Global and Sequoia Capital India, among others. In FY23, it reported consolidated revenues of ₹2,268 crore, 53% growth YoY, driven by an increase in enterprise and SME customers.

Isha Ambani

ISHA AMBANI, director, Reliance Retail, nowadays construes what Sam Walton, founder of Walmart, once said: “The secret of successful retailing is to give your customers what they want.” Isha is now building an inclusive retail business through a variety of brands and strategic partnerships, including Campa Cola, Sosyo, and Lotus. Wherever she finds a gap in products and pricing, Isha tasks the retail team to bridge it with in-house brands. The eldest child of RIL chairman Mukesh Ambani will complete 10 years on the board of Reliance Retail this year. In the initial two years until 2016, Isha was in the learning phase, focusing on profitability at each store. In the second phase, she began involving herself in the consumer side of retail as well as the telecom business, which launched in 2016. India’s largest retailer operates 18,774 stores with an area of 72.9 mn. sq. ft. It posted operational revenue of ₹2.52 lakh crore in FY24, and net profit of ₹7,045 crore. When she joined the business in FY15, Reliance Retail had 12.5 mn. sq. ft. of space and 2,621 stores. Isha is now focused on enabling artisans and small merchants to thrive alongside modern retail. JioMart has on-boarded over 25,000 artisans, weavers and micro-entrepreneurs. She is also building a designer label powerhouse from India by partnering with some of India’s best designers, such as, including Manish Malhotra, Abu Jani Sandeep Khosla, Anamika Khanna and Ritu Kumar.

Jay Kotak

IN AN ERA where digital transformation dictates the pace of progress, Kotak Mahindra Bank has been quick to capitalise on the shift with the launch of 811, a digital-only app whose name stands for India’s tryst with demonetisation in 2016. Under Jay Kotak’s co-leadership, Kotak811 accounted for 72% of all new accounts opened by the bank last year. As of March 2023, 811 had 17.5 million savings accounts, of which over 5 million were opened just last year. Kotak’s plan though extends beyond digital transactions; he envisions Kotak811 as a leader among technology companies that are revolutionising banking. “The big learning is trust and reputation really matters for Indians even in digital world,” says the eldest son of founder Uday Kotak. Jay’s strategy involves focusing on high-use case offerings such as debit and credit cards, FDs, and UPI transactions. “We are part of a bank, we’re not a fintech. But the way we think about the world is similar to how Cred would think,” says Jay. His additional role as SVP conglomerate relationships is helping him build ties with both the retail and corporate banking sectors, leveraging insights from each to drive innovation. “If you look at the credit-to-GDP ratio in the U.S. and at the sophistication of their consumer credit industry… The number of people that consume those products and have financed them on a reasonably robust banking system, gives me hope that India is getting there and we’re doing a solid job as an industry,” believes Jay.

Karan Adani

ON MARCH 26, India’s largest port operator Adani Ports and Special Economic Zone Ltd. (APSEZ) acquired Gopalpur Port in Orissa for ₹3,080 crore from Shapoorji Pallonji Group and Orissa Stevedores. Adani now owns 15 ports across India’s east and west coast — 355 million metric tonnes (MMT) capacity in the West and 272 MMT in the East. Besides, APSEZ operates Israel’s largest port Haifa, has O&M contracts at ports in Australia and Tanzania, and is building a container terminal at Colombo. Phase one — with a capacity of 18 MMT — of India’s first deepwater international seaport and container transhipment terminal at Vizhinjam near Thiruvananthapuram will be operational next year. The port, 10 nautical miles from the international sea route, will make India a key player in global sea trade. “Vizhinjam has the potential to compete with Colombo, Singapore, Port Klang and Jebel Ali,” Karan Adani, MD, APSEZ, said during the inauguration. The moves are part of Karan’s aim to make APSEZ the world’s largest port operator (and carbon neutral) by 2030. APSEZ invested around ₹27,000 crore on capacity expansion and six acquisitions in FY23 alone. Revenues grew 22% YoY to ₹20,852 crore in FY23, while net profit rose 9% to ₹5,393 crore. For the first nine months of FY24, revenues increased 32% YoY to ₹19,814 crore, while PAT went up 43% to ₹6,089 crore. APSEZ handled 420 MMT of cargo in FY24, 24% increase YoY, with domestic ports contributing over 408 MMT. Other than APSEZ, Karan also oversees the cement business of the group, as an independent and non-executive director. According to insiders, Karan plays a key role in strategic decisions at the group level, especially in bringing alliances and investors in various businesses.

Mehul Agrawal

MEHUL AGRAWAL, co-founder and COO of Cars24, India’s largest used-car platform, spends a significant amount of time building the company’s overseas businesses. The pre-owned car company started international expansion during the pandemic. Now, almost 30% of its revenues come from outside India. Australia is its biggest overseas market followed by Thailand and the U.A.E. Cars24 has invested between $50 million and $100 million in each of these markets. Yet, India remains the core of what Cars24 is building. That’s because the $25 billion used-car market in the country is unorganised and underpenetrated. “Out of 1,000, only 30-35 people own a car in India. In the Western world, this would be 800-900. That’s the scope of India,” says Agrawal. Over 4 million new cars were sold in the country last year (excluding exports), making it the third-largest auto market by volume. The used-car market is one and a half times bigger at 6-7 million, says Agrawal. Cars24 sold about 3 lakh cars last year, cornering a 5% share in India’s used car market. “Every used car is unique. The make, model, variant, year, colour, insurance, and repairs make the car different. Pricing it is a game of data. We have got so much data in the last 10 years. This is our moat which no other firm will be able to build easily,” says Agrawal. The company’s topline grew 8% YoY to ₹5,535 crore in FY23, while losses narrowed by 57% to ₹468 crore. “FY23 was a year for us to focus on economics. We made sure that growing beyond this point is not becoming an expensive choice of burning money and how can we get to the break-even faster,” says Agrawal. “Our global burn across markets came down by almost 80%. So that became the core agenda. When we look at growth, it is not just vanity metric of how many cars and how many transactions. Eventually, a business is there to create money. We are not here to create valuation,” he says.

Mukul Rustagi, Bhaswat Agarwal

“TAKING A leap of faith is a verb. We took it in our naiveté of 25-year-olds,” says Mukul Rustagi, co-founder and CEO, Classplus. Run by friends Mukul Rustagi and Bhaswat Agarwal (co-founder and COO), Classplus offers teachers running tuition centres or online teaching modules a secure online software, even a website and an app for courses and content to marketing support, in exchange for an annual fee. The firm designs software on which a neighborhood teacher or creator can run their websites and apps. It charges SAS fee as well as a small percentage of the revenue generated by the creator. Almost 25 million students use the platform offered by Classplus. Revenues have grown from ₹45 crore in FY22 to ₹149 crore in FY23. The company has onboarded 20,000 creators, including those selling yoga, astrology courses, spoken english, personality development, and even farming. The team at Classplus also curates strategies to help tutors/creators grow — from venturing online to publishing their courses, pricing, content curation and reaching a global audience.

Namit Jain

BACK IN 2015, there was a dichotomy in the four-wheeler segment. While 70% of buyers could easily get loans for new cars, only 3% used car buyers could avail finance. Namit Jain saw this as an opportunity and started Rupyy, a loan discovery platform for used vehicles which helps customers avail loans at point of sale using its QR code, distribution partner app and websites of Rupyy consumer affiliates (e.g. CarDekho.com) through its website. The business model revolves around a service fee charged to its 40-plus lending partners. It also operates a financing arm that generates interest income. Rupyy has been profitable for past two fiscals and is poised to achieve double-digit bottom line margins by FY25, says Jain. Rupyy sold its services to around 2,50,000 customers in FY24 and has facilitated over $1.6 billion in annualised loan disbursals by collaborating with 35+ financial institutions. Unlike typical lending platforms that connect the buyer with the lender, the Rupyy platform connects the buyer, the lender and the distributor. Rupyy uses a proprietary machine learning fair market valuation tool and a digital title transfer workflow across thousands of local government authorities. Approval rate is more than 80%. The company registered 63% year-on-year growth in 2023. Revenues surged 51% and hit an annualised run rate of $66 million in December 2023. EBITDA margins touched double digits by March 2024. In 2023, Rupyy also scaled up its new car financing vertical to $500 million in annualised disbursals.

Nibhrant Shah, Dhimaan Shah

WHERE do India’s wealthiest travel besides local destinations like Udaipur or Goa? It’s either Europe or tropical places like Bali and Koh Samui. That’s where Isprava Group has expanded its hospitality business, Lohono Stays, globally in last two years with locations in Phuket and Koh Samui in Thailand, Bali in Indonesia, Maldives and Sri Lanka. The company was founded in 2016 by brothers Dhimaan and Nibhrant Shah, investment bankers who returned to India after stints in London and New York. “We cater to customers who are as likely to spend holidays outside India as inside India. We have almost 250 homes, over 1,000 rooms, outside India,” says Nibhrant Shah. It plans to expand in Europe too. “We are looking at Italy, Greece, south of France,” he adds. Mumbai-based Isprava Group, which owns luxury real estate developer Isprava (average ticket size ₹10 crore) and real estate brand Chapter (average ticket size ₹5 crore), besides Lohono, is on an expansion spree. “We have grown at 65% CAGR over a five-year period,” says Dhimaan Shah. The company reported sales of about ₹700 crore in FY24, up from ₹530 crore in FY23.

Nikhil Kamath

A COMBINATION of words ‘Zero’ and ‘Rodha,’ Sanskrit for ‘barrier,’ Zerodha has been true to its name when it comes to serving common investors. Founded in 2010 by Nikhil Kamath and elder brother, Nithin, Zerodha has emerged as a disruptor in retail category by offering discount brokerage. It has more than one crore retail subscribers who account for over 15% retail volumes in Indian stock market. Last fiscal, it managed an asset base of ₹3 lakh crore, making it India’s largest retail-focused broker. In FY23, Zerodha reported revenue of ₹6,875 crore and profit after tax of ₹2,907 crore. The company had reported ₹4,964 crore revenue and ₹2,000 crore profit in previous year. Nikhil is India’s youngest billionaire with a net worth of $3.1 billion, according to Forbes Billionaires List 2024. In 2021, he co-founded Gruhas, a venture capital fund, with Abhijeet Pai. He is also involved with various organisations and foundations such as Rainmatter, Giving Pi, Bridgespan, British Asian Trust and YUVA.

Pranav Bajaj, Ravjot Arora

WHEN PRANAV BAJAJ and Ravjot Singh met at a friend’s place, they had no idea they would become business partners. They enjoyed each other’s company and often discussed personal stories of their life. Once they ended up discussing how difficult it was to get to hospital. It was not long before the idea of making ambulance services more efficient took hold. Both pooled around ₹10 lakh each and began aggregating all ambulance services in Delhi. Medulance also owns 400 ambulances. It serves 100 cities and, starting with Delhi, is now focusing on tie-ups with state governments. The service is backed with a call centre ’offering a voice of trust’ and trained personnel. It has also set up Medu clinics and a training institute, Medulance Healthcare Academy, for emergency response. As a team, Ravjot contributes through his technology background, while Pranav backs the team with his business acumen. Medulance generates revenue through subscriptions, both retail and corporate. Recently, in addition to going on Shark Tank, they also closed their first round of funding at $3 million with Alkemi Growth Capital as lead investor led by Deepinder Goyal, apart from Dexter Capital, Aman Gupta and Namita Thapar.

Pulkit Khurana, Siddharth Sikka

PULKIT KHURANA and Siddharth Sikka are no novices to mobility. Before Battery Smart, a battery-swapping network for electric two-wheelers, three-wheelers and e-rickshaws in 2019, the IIT-Kanpur graduates had tried their hands on an intracity bus pooling application in 2015. In 2020, they set up first battery-swapping station in Delhi-NCR. It has since expanded in 28 cities with 1,000 stations. Battery Smart partners with small businesses to set up stations. The partners are responsible for maintenance, infrastructure and electricity connection. For every swap, the vehicle owner pays ₹50-100 to Battery Smart. Of this, 40% goes to the partner. “Customer service and dense network is what differentiates us,” says Sikka. Battery Smart does more than 80,000 swaps in a day. It wants to scale up by five times in next 15 months. The company is also evaluating a foray into battery storage solutions by repurposing the batteries. For FY23, it incurred a loss of ₹61 crore as against a loss of ₹12.86 crore in previous year. The company has raised $100 million so far.

Rahul Nainani, Gurashish Singh Sahni

IT WAS A weekend in 2016 when Rahul Nainani and Gurashish Singh decided to attend the Google Startup Weekend in Mumbai. The event proved to be a turning point of their careers by giving them a business idea—a clean-tech start-up providing waste management solutions. Nainani, who holds a finance degree and Singh, working in real estate sector, wanted to offer much more than plastic waste management. With the motto of ‘Circular Economy and Circular Solutions,’ they wanted to build a traceable reverse supply chain for all types of waste. “The idea is to build an inclusive business model as we close the loop on plastics,” says Nainani. ReCircle has a presence in more than 270 cities and towns and 400 collection partners. It has also partnered with big FMCG brands such as Hindustan Unilever, Dabur, Coca Cola, Marico, Nestle and Starbucks India. It helps these brands offset their plastic footprint by providing them plastic credits. Plastic credit is among its main sources of revenue. The second source of revenue is partnerships with international organisations for capacity building and plastic waste recovery. In FY23, the profit was INR 2.45 crore, INR 1.77 crore more than in FY22. ReCircle, which has raised a pre series A round from Flipkart Ventures, 3i Partners and Acumen Fund Inc. also plans to work on new waste supply chains such as textiles, glass and paper waste.

Rishabh Shroff

AS HEAD of international business development of corporate law firm Cyril Amarchand Mangaldas, Rishabh Shroff is keeping a hectic schedule these days. Early to sense the direction of India’s investment flows, he was busy establishing an overseas office in Singapore last year. This year, the destination is Abu Dhabi, UAE. The corporate M&A vertical accounts for almost 70% turnover; others are litigation, banking and finance. “We are seeing a lot of investment interest from Middle East, specifically Dubai and Abu Dhabi. Number of Indians making family office investments and building investment structures in that region is also on the rise,” he says. Rishabh is also co-head of private client practice specialising in family constitutions and settlements, trusts, wills and succession planning. He also provides related advice to trustees and other private client service providers such as family offices and institutional and corporate trustees. “We are seeing a lot of situations where families are separating. So we are doing a lot of this work, either working with one family or one branch of the family,” says Rishabh. Last year, the firm added a new practice, intellectual property rights. “It is a key growth area for us,” he says.

Rohit Bhat, Suraj Subramaniam

AS BATCHMATES at The Wharton School, where they did MBA in 2012, Rohit Bhat and Suraj Subramaniam shared a belief that domestic internet companies will open colossal opportunities. Back in India, Rohit, an electrical engineer from IIT-Madras, joined Sequoia Capital. “I did tech investing for four years. I worked on investments in Practo, Ola Cabs and realised my heart was more in public than private market,” he says. Suraj was working with Temasek Holdings in India. The four-year stint in India from 2012 convinced them an opportunity was waiting to be tapped. Both set up Airavat Capital, an investment management firm focused on listed internet and technology-enabled businesses in consumer, financial service, technology and pharmaceutical sectors. One of the key initiatives in last one year is launch of Airavat Global Technology Fund R in June last year. “AUM is $100 million,” says Rohit. The firm runs two strategies, India and global technology, with two funds in each. India strategy focuses on technology businesses. “Major investments include KPIT Technologies, E2E Networks, Ujjivan Financial Services and PB Fintech,” says Bhat. Global strategy includes two funds. The portfolio is tilted towards software as a service (60%), fintech/payments (20%) and e-commerce (15%). “Major investments include Adyen, Block and Crowdstrike,” he says.

Shashwat Goenka

WHEN SHASHWAT GOENKA joined the $4.6 billion empire (RP-Sanjiv Goenka Group) a decade ago, the intent was to give a facelift to the over 200-year-old legacy business by foraying into new-age consumer-centric categories. When he joined, the group’s only new-age consumer business, Spencer’s Retail, was in choppy waters. After growing Spencer’s to ₹2,485 crore business, he has assumed charge of the group as its vice chairman. In retail, he has been focusing on luxury food retail with Nature’s Basket Artisan Pantry. Food retail is a tough business where most retailers have burnt fingers. Goenka says Nature’s Basket Artisan Pantry stores have broken even in second month of operations. “Most of our other formats take three quarters to break even,” he says. The format promises gastronomic experiences from across the world—The Cheese Room, where consumers can taste artisanal cheese from around the world, Spice Souk, inspired by the spice market in Turkey, and Nibbs, a live artisanal chocolate brand. Goenka has also taken charge of the sports business. While ₹7,000 crore investment in Indian Premier League’s Lucknow franchise is most talked about (most expensive IPL team), RPSG’s first brush with sports was when it bought football club ATK Mohun Bagan in 2017. It is now one of the franchises of the Indian Super League (ISL). While most ISL teams are making losses of ₹30-35 crore, Goenka says ATK Mohun Bagan is close to breaking even. He expects profitability in IPL franchise too. “We will start making money less than three years from now,” he says. Goenka sees a huge advantage in being part of a legacy conglomerate. “It enables you to create new legacies.”

Shruti Shibulal

SHRUTI SHIBULAL, who has established Tamara as a luxury eco-friendly destination, believes domestic tourists will drive growth. The CEO and Director of Tamara Leisure Experiences says FY23 was an year when demand touched pre-Covid level with people undertaking more long distance travel. For instance, Tamara’s latest NABH-certified Ayurvedic hospital and resort, Amal Tamara at Alleppey, has 50:50 domestic and foreign tourists in spite of longer stay programmes ranging from seven to 21 days where ayurveda, yoga and meditation are bundled into a package costing more than ₹1.5 lakh. “Demand for wellness and well-being, especially ayurveda, has increased in last couple of years,” she says. Tamara Leisure Experiences operates in three segments—Five-star The Tamara Resorts, upscale business hotels O by Tamara and mid-segment Lilac Hotels. In FY23, it added two more properties, a 141-key hotel under O by Tamara in Coimbatore and a 38-key property under Lilac Hotels in Guruvayoor. The company is also looking to open a property at Kumbakonam. According to MCA filings, revenue was ₹107.94 crore in FY23 compared with ₹60.19 crore in FY22. In FY23, it turned profitable with ₹4.3 crore profit compared to ₹20.42 crore loss in previous year. Tamara is also expanding through management contracts. Shruti says domestic travel, especially around spiritual and religious tourism, is a big market waiting to be tapped. “We have had that strategy for years,” she says. The company is now developing properties in Velankanni and Bodhgaya. “The spiritual/pilgrimage travel has been always strong in India and there is a huge opportunity to create experiences for people like us; and not necessarily in the luxury space,” says Shruti.

Sudarshan Venu

TVS MOTOR climbed three spots to become India’s second-largest electric two-wheeler manufacturer in FY24, the only legacy automaker in the Top 3 list. It sold over 40 lakh two-wheelers. Of these, 1.83 lakh were electric, up 123% from 82,108 in previous fiscal. “Electrification has been a huge focus,” says MD Sudarshan Venu. He expects electric vehicles to contribute 20-25% to volumes in three years from 5% at present. The government wants 80% of all two-wheelers sold to be electric by the end of the decade. “We have developed a complete range, from small scooters which you will see soon to mid-size electric iQube and premium electric scooter TVS X,” says Venu. TVS will also enter the electric three-wheeler market. Globally, the company gets a bulk of export revenue from Africa, which has underperformed recently. TVS Motor is also venturing into western markets like Europe and U.K. It acquired Britain’s iconic sporting motorcycle brand Norton in 2020 in which it is investing £100 million. “We will play it in a totally differentiated way as brand Norton comes to life again next year,” he says. TVS has had a decade-long partnership with BMW Motorrad. The company is also looking at new categories such as e-bikes. It has acquired Switzerland’s largest e-bike maker Swiss E-Mobility Group. Venu also leads the group’s financial services. “Today, 25% of our group profits come from financial services, most of which is non-two-wheeler,” he says. “We have over 15 million consumers on the platform and over ₹30,000 crore of AUM. Financial services is going to be a big opportunity,” he says.

Sumit Gupta, Neeraj Khandelwal

SUMIT GUPTA AND NERAJ KHANDELWAL, founders of India’s biggest crypto investment app by volume with user base of over 1.4 crore, have been friends for 15 years since their coaching days in Kota. The duo started their entrepreneurial journey in 2018 from a small flat in Mumbai. Last valued at $2.1 billion in 2022, the company, which competes with CoinSwitch and Unocoin in India and Binance and Gemini globally, has raised $247 million in six funding rounds; it entered unicorn club in 2021. With average daily trading volume of ₹246.5 crore and 500+ trading pairs, CoinDCX is becoming popular with crypto investor through investment app CoinDCX Go, crypto trading platform CoinDCX Pro and investor education platform DCX Learn. The company’s revenue comes from fee on buying and selling cryptos (0.1% transaction amount), as well as partnerships with other companies in blockchain and cryptocurrency. Neblio Technologies, the Indian arm of CoinDCX, which is registered in Singapore as Primestack Pte., turned profitable in FY23. The company ended FY23 with a net profit of ₹28 crore against a net loss of ₹41 crore in previous fiscal. “Around 50 million people should be able to use blockchain technology in India in their daily lives in next five years,” says Khandelwal. He adds in India, blockchain can be directly added to applications. “You don’t need to build a completely new world of mobile applications as blockchain can be integrated directly inside apps that people are already using.”

Tanya Singhal

GONE ARE the days of limited women representation in energy, resources and infrastructure industries. Ask Tanya Singhal, who founded renewable energy platform SolarArise and started Mynzo Carbon, a tech platform focussed on increasing climate consciousness by using AI. Tanya, an IIT-Delhi and Royal Institute of Technology, Sweden, alumnus, entered the solar industry in 2010 after leaving her job at Boston Consulting Group. After working for a few years at a solar thermal firm, she set up solar asset management vehicle SolarArise with colleagues James Abraham and Anil Nayar. “I worked to position solar energy on a par, or even lower, than conventional sources,” she says. Backed by Core Infrastructure India Fund Pte Ltd., managed by Kotak Mahindra Group, and Global Energy Efficiency and Renewable Energy Fund, advised by European Investment Bank Group, SolarArise raised and deployed over ₹2,000 crore to build solar plants totaling about half GW. In FY23, it reported consolidated revenue of ₹170 crore, up 30% from same period last year. After eight years of leading SolarArise, Tanya sold the portfolio to investor ThomasLloyd Energy Impact Trust. After the exit, she co-founded Mynzo Carbon with James Abraham. Mynzo (MyNetZero) is developing new-age technologies to help individuals and businesses reduce their carbon footprint.

Tarun Saini

HAILING FROM a small village 40 kms from Ambala, Tarun Saini is on a mission to give a leg-up to education in Bihar, Uttar Pradesh and Gujarat through his online edtech platform Vidyakul. Saini, who comes from a family of agriculturists, was helped by his teachers to sign up for scholarships. Later, his father mortgaged his land to send him to Australia, where one of his elder sisters was married, for studies. After returning, he registered his company in 2017, started work in 2018 and opened the platform for first 6,000 students in 2021. In 2023, it had 63,000 paying students. Vidyakul teaches high school students (IX to XII) all subjects for ₹300 a month in their dialect. It follows curriculum recommended by respective state boards. The platform opens doors especially for girls who drop out of school because they cannot go to Tier-II/III towns for education. While Vidyakul’s YouTube channel works as a funnel to drive in students by offering free content, the live tutoring platform gives students the opportunity to interact with teachers. Saini runs Vidyakul like a mission with 70 people in Gurgaon and 60 teachers and academic support staff running the studios. Investors include JITO Angel Network, Indorama, Nadathur family, Dholakia Ventures. Vidyakul ended FY23 with a turnover of ₹15 crore. Along with co-founder Akhil Angera, a former intern who focuses on academic side as well as enrolments, and Raman Garg, who handles IT, Saini says they have barely dipped into the opportunity.

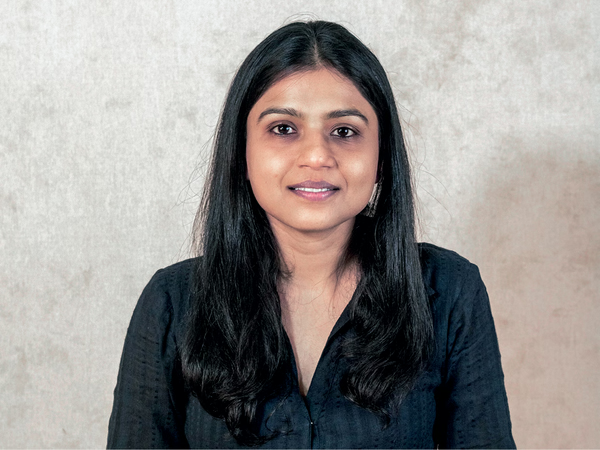

Udita Bansal

LOOKING TO carve out a space in contemporary ethnic apparel, Udita Bansal started her entrepreneurial journey in 2019 with trueBrowns. Armed with a modest investment of ₹15 lakh for first two years, Bansal, an alumna of National Institute of Fashion Technology, set out to tap the over ₹70,000 crore women ethnic wear market, 85% of which is unorganised. “There was no brand bringing ethnicity in a more contemporary way,” says Bansal, who describes her designs as ‘urban ethnic’. trueBrowns took another leap when it embraced inclusive sizing. It expanded its size range from 2XS to 6XL, challenging conventional sizing practices. Around 20% sales come from the extreme size portfolio. After establishing a presence in smaller online marketplaces, trueBrowns launched its own website in 2019. Bansal attributes the brand’s success to its distinctive design language, particularly its innovative approach to silhouettes. During early days, trueBrowns handled manufacturing in-house but as the brand evolved, outsourced production to third-party manufacturers in Delhi-NCR. The brand anticipates 1.5 times growth in FY25. Last year has been significant, characterised by establishment of international business through a microsite, expansion into men’s segment and initiation of retail operations. International business, which began in January 2023, already contributes nearly 25% to overall revenue with U.S. being the biggest market, followed by U.K. The brand also launched men’s wear in October 2023. The segment contributes 5% to revenue. “In just five-six months, this is a significant contribution. For the entire year, I expect it to grow to 10%,” says the founder.

Vidit Aatrey, Sanjeev Barnwal

WHAT happens when two friends with entrepreneurial fire in their belly join hands? It unfolds the path to the fastest growing e-commerce platform in India with a valuation of $3.9 billion. Sanjeev Barnwal and Vidit Aatrey, IIT-Delhi alumni, founded Meesho in 2015 to help small and medium companies build online presence. What started as a journey of going door to door to convince micro-entrepreneurs has become a venture that aids more than two million merchants on its platform. “In 2015, e-commerce had branded products, being sold to Tier-1 customers. We were sure that existing models will not bring everyone, especially small businesses, online,” says Aatrey. Meesho’s e-commerce ecosystem enables small businesses to foray into online space. The target is primarily consumers from Tier-II cities and beyond. One of the pull factors is industry-first zero commission for sellers on the platform. Tech innovations, seller-friendly policies and asset-light structure have helped it emerge as the lowest-cost destination for small businesses. Losses shrunk 48% from ₹3,248 crore in FY22 to ₹1,675 crore in FY23. It remained cash flow positive in H1 of FY24. Total funding is $1.06 billion, according to Tracxn. The Bengaluru-based duo says pandemic forced sellers to recognise Meesho’s potential. They see huge opportunity as only 7% retail has moved to e-commerce in India. Their impact is evident in the fact that 10% of India’s population (more than 140 million) has made at least one transaction on the platform. In 2023, 150 million people, or unique transacting users, bought at least one product from Meesho. In fact, according to data.ai, Meesho recorded 14.5 crore downloads in 2023, making it the most downloaded shopping app in India every day for nearly three years.

Yogesh Chaudhary

INSPIRED BY entrepreneurs such as Steve Jobs, Bill Gates and Mark Zuckerberg, Yogesh Chaudhary, director of Jaipur Rugs, did what they did—dropped out of college. But instead of starting up, he joined the family business at 19 to assist his father, following losses due to a robbery and resignation of several senior executives. The first decision was to prioritise exports and expand beyond U.S. into Middle East, Germany, Europe and South Asia. In 2016, Jaipur Rugs forayed into retail and now sells in more than 90 countries. “We sell to some of the world’s high-end brands. When we entered consumer space, we realised innovation needs to be faster,” says Chaudhary. The company collaborates with designers such as Shantanu Garg and Gauri Khan. The artisanal rugs are a result of nurturing of 40,000 artisans in 600 villages of five states over 50 years. About 90% are women weavers. In fact, Jaipur Rugs did not opt for middleman-owned looms and instead granted weavers ownership of looms, disrupting the age-old practice of transporting artisans to factories, eliminating the need for large manufacturing set-ups. Leveraging technology, it launched the “Tana Bana App” in 2018 which maintains a comprehensive repository of work hours. The brand’s ethos is built on empathy, kindness, happiness and, most important, transparency. Despite geopolitical tensions which disrupted supply chains, it achieved a turnover of ₹766 crore in FY22. In FY23, it grew another 18% to ₹920 crore. The company aims to open 35 more stores in five years. Yogesh continues his father’s commitment to social impact, attributing much of Jaipur Rugs’ success to the people-centric model established by Nand Kishore Chaudhary in 1978. “What keeps me going is the impact the business has on peoples’ lives,” he says.

Zaheer Adenwala

IN 2012, during a philanthropy course at Dasra, a service provider for ultra-high-net-worth individuals, Zaheer Adenwala’s journey took a pivotal turn. The exposure to North American crowdfunding platforms highlighted a significant underutilisation of technology in the social sector in India. Zaheer and his co-founders, Varun Sheth and Kunal Kapoor, saw an opportunity to use technology to connect givers with causes. Ketto operates on a hybrid business model, charging a platform fee from non-profit partners for fundraising. It has also incorporated a donor tip feature to encourage contributors to leave a gratuity and offers amplified services for fixed-fee digital marketing support. Starting with initial bootstrapped capital of ₹21 lakh, the journey was not devoid of challenges. “Convincing donors to contribute and navigating the landscape pre-demonetisation were significant early obstacles,” says Adenwala. Ketto has impacted over 1 crore lives and raised over ₹2,000 crore since inception. It has raised $10 million in three rounds.

Post a comment