How 2 friends built a startup that brings in $226 million a year: ‘It was a big risk, but it paid off’

When Jessica Rolph had her first child in June 2010, she wanted to know everything about his developing brain.

“There’s a lot of expertise that goes into understanding curriculum for 5- and 6-year-olds when they start school,” says Rolph, 49. “But what about the early years?”

She dove into early childhood development research, seeking to understand exactly how baby toys’ flashing lights and sounds affected her young son’s neural pathways, and came up short on answers.

That experience led her and her friend Roderick Morris in 2015 to co-found Lovevery, a Boise-Idaho based company that makes developmentally-minded toys and playthings for children ages 0 through 5, and learning guides for parents.

The company brought in $226 million in revenue last year, according to documents reviewed by CNBC Make It. It aims to reach profitability this year, says Rolph.

Lovevery’s toys are inspired by the homemade ones Rolph made for her son, each designed to nurture a specific developmental milestone. She recalls asking her husband to buy some PVC pipe from a hardware store, for example, so they could saw off a section and watch their son put something through the tube. The goal was to further his understanding of the concept of items containing other items.

“It was so empowering. It was also so exciting to see him just light up when I gave him these experiences,” Rolph says.

Here’s how she and Morris got started.

Launching with a single product

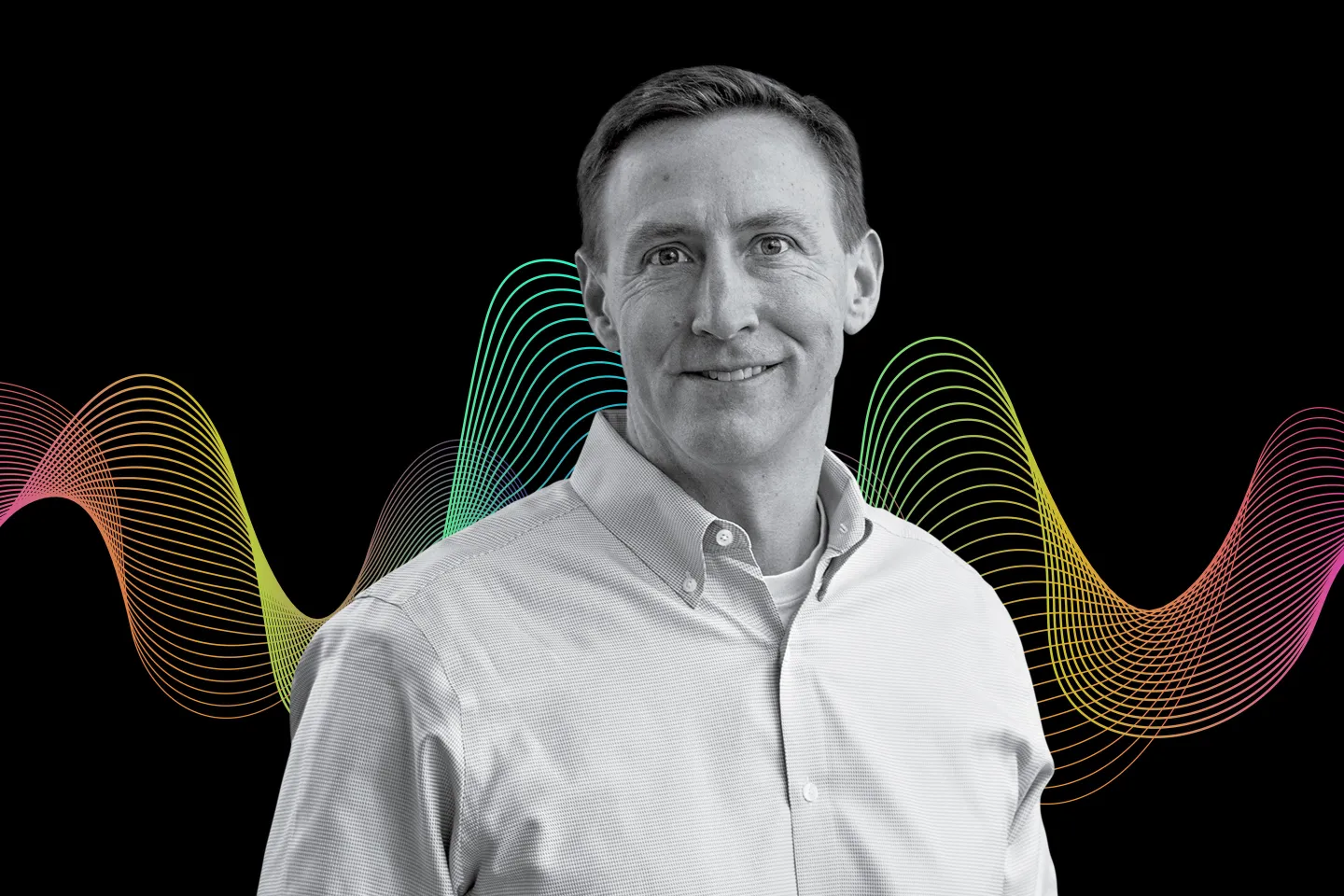

Prior to starting Lovevery, Rolph was a co-founder of organic baby food company Happy Family, which launched in 2005. She’d been friends with Morris — who had experience helping grow tech startups, including a marketing and operations executive role at energy company Opower — for more than a decade.

“We never thought of [Lovevery] as just a toy company,” says Morris, 52. “We thought of it as this platform that was going to help parents and children both work on early childhood together.”

The duo decided to start simple, focusing on a single product: a play gym. It was the most popular item on most people’s baby registries, but many extant options were “junky-looking,” says Rolph. “We wanted to make it beautiful and like it would fit in with the aesthetics of families’ homes. We also, of course, wanted to make it developmental — and really make it based on these micro-stages of the first 12 weeks.”

They spent nearly two years relying on $2 million in seed funding to develop Lovevery’s play gym, finally launching it in 2017. At $140, it was roughly triple the cost of the most expensive play mats on the market at the time, Rolph says. But it came with soft cotton shapes for grasping, teething rings to engage babies from their first tummy time sessions through their first birthday and a guidebook for each graduated stage of brain development.

Within its first year on the market, the product brought in more sales than any other play gym on Amazon, says a Lovevery spokesperson.

“We thought with all this value, we could just go for it, and we thought people would want it,” Rolph says. “It was a big risk. But it paid off.”

A subscription model takeover

In 2018, Lovevery rolled out subscription play kits for infants ages 0 to 12 months, at $80 every two months. The goal was to create an ongoing relationship with families: Trust us to stay on top of our research, and we’ll regularly send you toys that fit your child’s current developmental stage.

Lovevery now sells subscription kits for kids up to age 5, each priced at an average of $40 per month. More than 350,000 people in 34 countries have signed up, responsible for 86% of the company’s revenue, a spokesperson says.

The steep price is a byproduct of quality, Morris adds — Lovevery’s cost-cutting efforts range from shopping for lower-cost manufacturers to tweaking how the wood gets cut for each product.

“In the early days, we got a lot of pressure from investors to find ways to cheapen our products so that we could get more margin and make the business more profitable,” says Morris. “We have instead focused on finding ways to take costs out of our structure that don’t affect the products at all.”

Customers seem unfazed. People who make a purchase are more likely to keep coming back over the next two years than at competitors KiwiCo and Little Passports, according to a Bloomberg Second Measure report published in 2021.

With loyalty come accolades and funding. Lovevery was named one of Fast Company’s Most Innovative Companies of 2024 in March. Meta CEO Mark Zuckerberg, whose Chan Zuckerberg Initiative has invested in the company, and NFL star Patrick Mahomes have shared pictures of their children using Lovevery’s products.

The company’s total fundraising figure is up to $132 million, including a $100 million round led by private equity fund The Chernin Group, says Morris. The co-founders maintain a controlling stake in the company, a Lovevery spokesperson notes.

And while customer growth is paramount — Lovevery needs economies of scale to become profitable, Rolph says — they don’t currently plan to rush any decisions.

“We can’t hurry the process,” Morris says. “We need to be as thoughtful and obsessive as we need to be, to have things that people are going to love and that children are not going to get tired of playing with.”

Post a comment